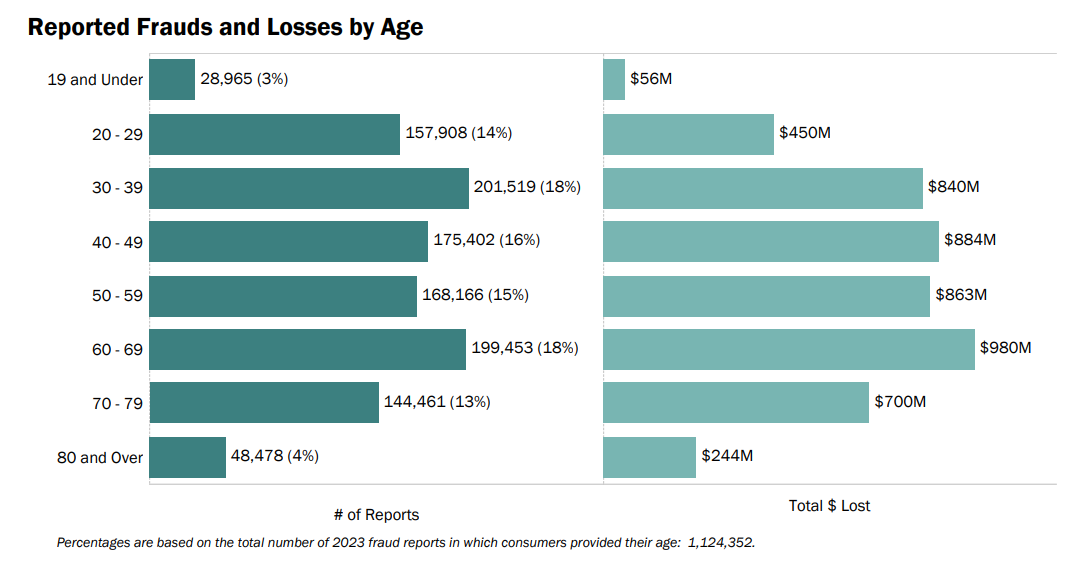

Studies filed with the U.S. Federal Commerce Fee (FTC) put the dangers in perspective — scammers squarely goal older adults. In 2023, adults aged 60 and up filed over one-third of all fraud studies. Their reported losses? Near $2 billion.

Whereas scammers goal all age teams, older adults provide them a selected benefit. Know-how and on a regular basis web use got here alongside later of their lives. They didn’t develop up with it like the remainder of us did, making them much less conversant in expertise and extra prone to assault. Furthermore, their lifetime financial savings, residence possession, and retirement accounts make them enticing targets.

That’s a lot the case with our grandparents right now. It’s little marvel hackers, scammers, and thieves go after them.

Figures courtesy of the FTC

Nonetheless, your grandparents have an enormous benefit working of their favor. You.

A chat together with your grandparents can preserve them safer on-line

Your information, your experience, and your general consolation degree with expertise and the web can assist them keep away from fraud. Have a chat about staying protected on-line. Or have a number of chats over time. The recommendation you go up could make all of the distinction.

Listed here are a number of methods you can begin:

- Speak in regards to the newest on-line scams.

Because the yr rolls on, so do the scams. Each rip-off has its season, from tax scams early within the yr to procuring scams throughout the holidays. Present occasions play in too. Within the wake of pure disasters, phony reduction scams make the rounds on the web. Encourage your grandparents to regulate the information for the most recent on-line scams in order that they have a greater likelihood of recognizing fraudulent exercise. Or higher but, give them a name if you get phrase of a brand new knowledge breach or rip-off.

- Present them assume like a cybercriminal.

The key to beating cybercriminals at their very own recreation is to assume like one. Encourage your grandparents to contemplate what could make them targets. Maybe they’ve giant retirement funds. Perhaps their on-line checking account is secured with a password that they use for a number of on-line accounts. Have them take into consideration how they’ve made it simpler for a criminal to make the most of them. From there, they will tighten up their safety as wanted. A instrument like our Safety Rating can do that for them. It stops weak factors and provides options for shoring them up.

- Strengthen their passwords.

Every account ought to get its personal sturdy, distinctive password. Which is a whole lot of work, given all of the accounts we preserve. A password supervisor can assist. It creates and securely shops sturdy, distinctive passwords for each account. (No extra sticky notes with passwords on the monitor.)

Additionally, assist them arrange two-factor authentication on their accounts that supply it. It supplies an additional layer of safety, because it requires a number of types of verification, reminiscent of a fingerprint scan or facial recognition. This, with sturdy, distinctive passwords, makes accounts terrifically powerful to crack.

- Present them spot phishing scams.

Hackers, scammers, and thieves all use phishing assaults to rope in victims. And right now, they give the impression of being more and more convincing because of AI instruments. And as we’ve coated right here on our blocks, scammers can simply clone voices — even faces—on calls and video chats. A lot extra phishing assaults come by textual content, e-mail, and cellphone calls. That is the place your grandparents must get savvy.

In the event that they obtain an e-mail that seems to be from a enterprise or perhaps a member of the family, however they’re asking them for their Social Safety Quantity, passwords, or cash, cease and assume. Don’t click on on something or take any direct motion from the message. As a substitute, go straight to the group’s web site and confirm that the message is respectable with customer support. If the message claims to be from a member of the family asking for monetary assist, contact them immediately to make sure it’s not a scammer in disguise. In all, make sure that they present nice warning any time a seemingly “pressing” e-mail, message, or name comes their manner. Urgency is commonly an indication of a rip-off.

- Set them up with complete on-line safety.

Immediately’s on-line safety goes far past antivirus. It protects individuals. Their gadgets, their id, and their privateness.

Complete on-line safety like our McAfee+ plans preserve them protected from hackers, scammers, and thieves in a number of methods. Contemplate this brief record of what complete on-line safety like ours can do in your grandparents:

Rip-off Safety

Is that e-mail, textual content, or message packing a rip-off hyperlink? Our rip-off safety lets your grandparents know earlier than they click on that hyperlink. It makes use of AI to smell out dangerous hyperlinks. And in the event that they click on or faucet on one, no worries. It blocks hyperlinks to malicious websites.

Net safety

Like rip-off safety, our net safety sniffs out sketchy hyperlinks whereas they browse. So say they stumble throughout a great-looking provide in a mattress of search outcomes. If it’s a hyperlink to a rip-off website, they’ll spot it. Additionally like rip-off safety, it blocks the positioning in the event that they by accident hit the hyperlink.

Transaction Monitoring

This helps them nip fraud within the bud. Primarily based on the settings they supply, transaction monitoring retains an eye fixed out for uncommon exercise on credit score and debit playing cards. That very same monitoring can prolong to retirement, funding, and mortgage accounts as nicely. It will possibly additional notify them if somebody tries to alter the contact information on their financial institution accounts or take out a short-term mortgage of their identify.

Credit score Monitoring

This is a crucial factor to do in right now’s password- and digital-driven world. Credit score monitoring uncovers any inconsistencies or outright cases of fraud in credit score studies. Then it helps put your grandparents on the trail to setting them straight. It additional retains an eye fixed on their credit score studies general by offering you with notifications if something adjustments of their historical past or rating.

Private Knowledge Cleanup

This supplies your grandparents with one other highly effective instrument for shielding their privateness. Private Knowledge Cleanup removes their private information from a number of the sketchiest knowledge dealer websites on the market. And so they’ll promote these strains and features of information about them to anybody. Hackers and spammers included. Private Knowledge Cleanup scans knowledge dealer websites and exhibits which of them are promoting their private information. From there, it supplies steering for eradicating your knowledge from these websites. Additional, when a part of our McAfee+ Superior and Final, it sends requests to take away their knowledge routinely.

Identification Theft Protection & Restoration

Say the unlucky occurs to your grandparents and so they fall sufferer to id theft. Our protection and restoration plan supplies as much as $2 million in lawyer charges and reimbursement for lawyer charges and stolen funds. Additional, a licensed skilled can assist them restore their id and credit score. In all, this protects them cash and their time if theft occurs.